Featured

Table of Contents

A degree term life insurance policy policy can give you tranquility of mind that the people who depend on you will have a survivor benefit during the years that you are planning to support them. It's a method to help deal with them in the future, today. A degree term life insurance policy (occasionally called degree costs term life insurance policy) plan offers coverage for an established variety of years (e.g., 10 or 20 years) while maintaining the premium payments the same for the duration of the policy.

With degree term insurance coverage, the expense of the insurance will certainly remain the exact same (or potentially lower if rewards are paid) over the term of your plan, typically 10 or 20 years. Unlike irreversible life insurance policy, which never ever expires as lengthy as you pay premiums, a degree term life insurance policy policy will certainly end at some time in the future, usually at the end of the duration of your level term.

What is Short Term Life Insurance? Discover the Facts?

Because of this, lots of people utilize irreversible insurance coverage as a steady economic planning tool that can serve lots of requirements. You may have the ability to convert some, or all, of your term insurance policy throughout a set duration, generally the first one decade of your policy, without needing to re-qualify for insurance coverage even if your health has actually changed.

As it does, you might desire to include to your insurance policy coverage in the future - Short Term Life Insurance. As this takes place, you might want to ultimately decrease your death advantage or think about transforming your term insurance to an irreversible plan.

Long as you pay your premiums, you can rest simple understanding that your enjoyed ones will certainly obtain a fatality advantage if you pass away during the term. Numerous term policies allow you the capability to convert to irreversible insurance coverage without having to take an additional health examination. This can allow you to take advantage of the additional benefits of an irreversible policy.

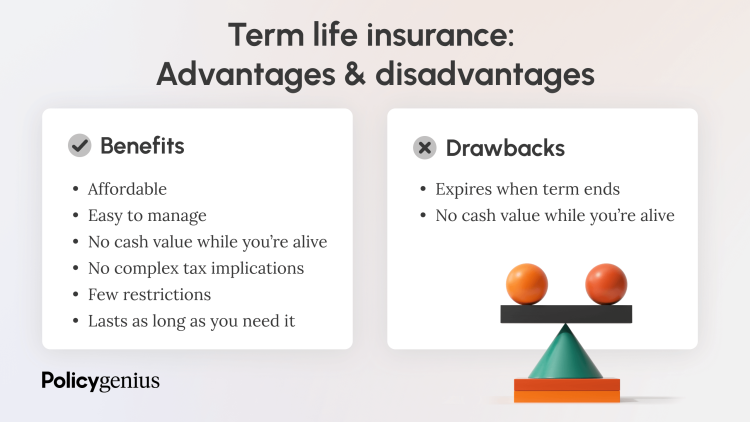

Level term life insurance policy is one of the most convenient courses into life insurance coverage, we'll talk about the advantages and disadvantages so that you can pick a strategy to fit your requirements. Level term life insurance is the most typical and basic type of term life. When you're looking for short-lived life insurance policy strategies, degree term life insurance policy is one course that you can go.

You'll fill up out an application that contains general individual info such as your name, age, etc as well as a more in-depth questionnaire concerning your medical history.

The brief response is no., for instance, let you have the convenience of fatality benefits and can build up cash money worth over time, meaning you'll have a lot more control over your advantages while you're alive.

What is Term Life Insurance With Level Premiums? Discover the Facts?

Cyclists are optional arrangements contributed to your plan that can offer you extra advantages and defenses. Bikers are a wonderful method to add safeguards to your policy. Anything can take place throughout your life insurance policy term, and you want to await anything. By paying simply a little bit extra a month, bikers can supply the support you require in instance of an emergency situation.

This cyclist offers term life insurance policy on your children through the ages of 18-25. There are circumstances where these benefits are developed into your plan, yet they can likewise be readily available as a different enhancement that calls for added payment. This rider offers an added survivor benefit to your recipient needs to you pass away as the outcome of a mishap.

Latest Posts

Burial Insurance For Elderly Parents

Final Expense Carriers

Affordable Burial Insurance