Featured

Table of Contents

"My advice is to purchase life insurance policy to cover the home mortgage in the event among the property owners passes away too soon (mortgage protection insurance cost and benefits). Do not simply get a quantity of life insurance coverage equal to the home mortgage amount you have various other economic bases to cover," Doug Mitchell, proprietor of Ogletree Financial, a life insurance policy company

It does not cover anything else such as last medical expenses or funeral prices like a conventional life insurance policy policy. The reason it can not be used for anything else is since the policy pays out to your lender not your recipients. While traditional policies pay to your family members and can be utilized however they desire, MPI pays to your lender and only covers the price of your mortgage.

For many home owners, the home loan is the biggest financial commitment they have. Some sort of mortgage defense is necessary for home owners because it guarantees that your household can continue residing in their home even if something unanticipated happens to you. Obtaining sufficient protection protects against the threat of your family facing repossession and offers financial security during a challenging time.

Yes, home mortgage protection insurance usually covers the home loan in the occasion of your fatality. It pays the continuing to be balance straight to the loan provider, making certain that your household can stay in the home without stressing over making home loan settlements. This coverage can be a valuable safeguard, avoiding foreclosure and supplying assurance throughout a tough time.

Picking term policy provides options for your family members to either utilize the survivor benefit to repay your home and utilize the leftover cash and even miss paying the mortgage and make use of the cash as they like. Nonetheless, if you are not eligible for term protection, a home mortgage insurance plan is an excellent alternative.

Mortgage Protection Insurance Rate Calculator

It is less costly, much more safety, and extra versatile than many home mortgage defense insurance policy companies. Age Age 16 20 21 24 25 34 35 44 45 54 55 64 65+ Coverage Amount Coverage Quantity $50,000 $100,000 $100,000 $200,000 $200,000 $300,000 $400,000 $500,000 $500,000 $1,000,000 $1,000,000 $2,000,000 $2,000,000 $5,000,000 $5,000,000+ Insurance Coverage Type Protection Type Whole Life Term Life Final Expenditure Not Certain Sex Gender Man Women Non-Binary.

So you've closed on your home loan. Congratulations! You're now a house owner. This is just one of the largest financial investments you'll make in your life. And as a result of the time and money you've invested, it's likewise one of the most crucial steps you'll take in your lifetime. You'll want to make certain that your dependents are covered in situation you pass away before you pay off your mortgage.

They might attract customers who remain in bad health or that have inadequate case histories. Home mortgage life insurance policy is an unique type of insurance policy plan supplied by banks that are connected with loan providers and by independent insurance provider. It's not like various other life insurance policies. As opposed to paying a survivor benefit to your recipients after you die as traditional life insurance policy does, mortgage life insurance just settles a home mortgage when the customer dies as lengthy as the lending still exists.

Is There Ppi On Mortgages

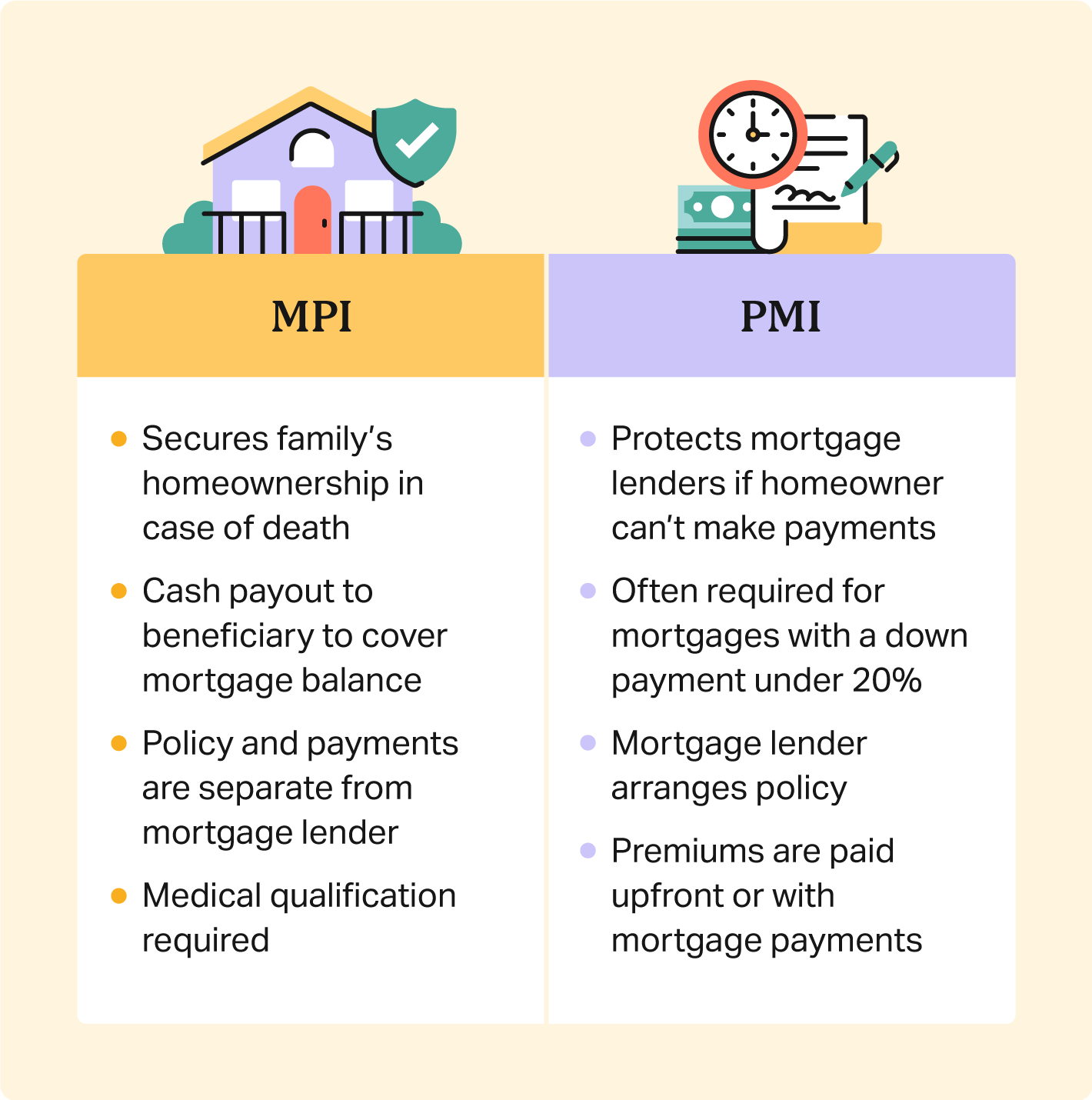

If there's no mortgage, there's no reward. Something to maintain in mind: do not perplex home loan life insurance coverage with home loan insurance. The last is private insurance that should be secured as a problem of some conventional home loans. While mortgage life insurance policy can shield youthe borrowerand their successors, mortgage insurance safeguards the loan provider if the debtor isn't able to satisfy their monetary obligations.

Home mortgage life insurance coverage is not home loan insurancethe latter protects the lender in situation the customer defaults on their home loan for any reason. As soon as you have actually shut on your finance, be on the search for routine mailouts and telephone call attempting to market you a home mortgage life insurance policy plan. These solicitations are typically disguised as main requests from mortgage lending institutions.

The other kind of mortgage life insurance is called degree term insurance. With this kind of policy, the payment doesn't decrease.

Another possibility is to acquire a plan that offers extra protection for a cheaper cost previously in your home loan term. When you have actually paid for the principal considerably, think about switching to an assured concern term policy. Some plans might return your premiums if you never ever submit a case after you pay off your home mortgage.

Plus, you will certainly have most likely squandered the opportunity to invest any money you would certainly have conserved, had you acquired less costly term life insurance. In reality, home loan defense life insurance policies are generally ill-advised.

This sort of home loan life insurancewhich is sometimes referred to as decreasing term insuranceis designed to pay off your home loan equilibrium, while each month your recipient pays for component of your mortgage principal. Consequently, the policy's prospective payment shrinks with every mortgage settlement. On the various other hand, some newer products have actually an attribute referred to as a level death advantage where payments do not decline.

Endowment Mortgage Insurance

A better treatment is to just acquire more life insurance coverage. Those concerned concerning leaving behind expensive mortgages to their loved ones must consider term life insurance policy, which is an usually superior service to home loan security life insurance policy. New York City Life, one of the finest life insurance coverage firms. mortgage payment protection insurance, offers adaptable term life insurance policy policies.

We all wish to guarantee our liked ones are monetarily protected. Yet that doesn't imply everybody desires protection for the exact same factors. So it makes good sense that there's various types of insurance policy to select from. This post thinks about home loan protection insurance, life insurance coverage and mortgage life insurance policy. Exactly how does home mortgage life insurance policy differ from a common life insurance plan? Both of these sorts of life insurance policy can be made use of for home mortgage defense functions, yet that doesn't inform the entire tale.

Life insurance policy is generally a plan that gives level cover if you pass away during the size of the plan. In various other words, the quantity of cover stays the exact same until the policy finishes. If you're no longer around, it can supply protection for a home mortgage, and certainly any kind of purpose, such as: Assisting loved ones pay the home bills Supporting youngsters via higher education Paying the rental fee (not just home mortgage protection).

For the objective of the remainder of this post, when chatting about 'mortgage life insurance policy' we are describing 'lowering home loan life insurance policy'. Simply bear in mind that life insurance coverage is not a cost savings or financial investment item and has no cash money worth unless a legitimate insurance claim is made.

If you're healthy and have actually never made use of tobacco, you'll generally pay more for mortgage defense insurance coverage than you would for term life insurance. Unlike other types of insurance policy, it's hard to obtain a quote for home loan defense insurance online. Rates for mortgage protection insurance can differ widely; there is much less transparency in this market and there are as well several variables to precisely compare prices.

Term life is a superb choice for home loan defense. Policyholders can benefit from a number of advantages: The quantity of protection isn't limited to your home mortgage equilibrium.

Life Insurance Or Mortgage Insurance

You might want your life insurance policy to protect more than just your home loan. You select the policy value, so your insurance coverage can be essentially than your home mortgage balance. You can even have greater than one policy and "stack" them for customized insurance coverage. By stacking policies, or riders on your policy, you could decrease the life insurance coverage benefit with time as your mortgage equilibrium decreases so you're not spending for insurance coverage you do not need.

If you're insured and pass away while your term life plan is still energetic, your picked loved one(s) can make use of the funds to pay the home mortgage or for one more objective they choose. There are several benefits to using term life insurance to shield your mortgage. Still, it may not be an ideal service for everyone.

Yes, because life insurance plans have a tendency to straighten with the specifics of a home loan. If you get a 250,000 residence with a 25-year home loan, it makes sense to buy life insurance policy that covers you for this much, for this lengthy.

Home Lenders Insurance

Your household or beneficiaries receive their swelling amount and they can spend it as they like. It is very important to understand, nonetheless, that the Home loan Security payment sum lowers in line with your home mortgage term and equilibrium, whereas degree term life insurance coverage will pay out the very same swelling amount at any time throughout the policy size.

You may see that as you not obtaining your payout. On the other hand, you'll be alive so It's not like paying for Netflix. You do not see an evident or in advance return of what you buy. The sum you invest on life insurance policy each month does not pay back till you're no much longer right here.

After you're gone, your liked ones do not need to bother with missing out on repayments or being unable to pay for living in their home. There are 2 main varieties of home mortgage protection insurance coverage, level term and reducing term. It's always best to get suggestions to figure out the plan that ideal speaks to your requirements, spending plan and situations.

Latest Posts

Burial Insurance For Elderly Parents

Final Expense Carriers

Affordable Burial Insurance